Get Your ITIN & Don't Delay Missing Important Deadlines!

Get Your ITIN to open a U.S. Bank Account, File Tax Returns and open PayPal, Stripe or other payment account without SSN

ITIN Done-For-You Service: $997

Today: $497 (50% Off Regular Service)

5.0 out of 5 Based on 3,043 Reviews

You Will Be Personally Working With...

Sina Bonabi

Certifying Acceptance Agent (CAA)

As IRS Certifying Acceptance Agents, we're TRAINED and AUTHORIZED BY THE IRS to assist non-U.S. citizens like you who don't have a Social Security Number (SSN) get their ITIN.

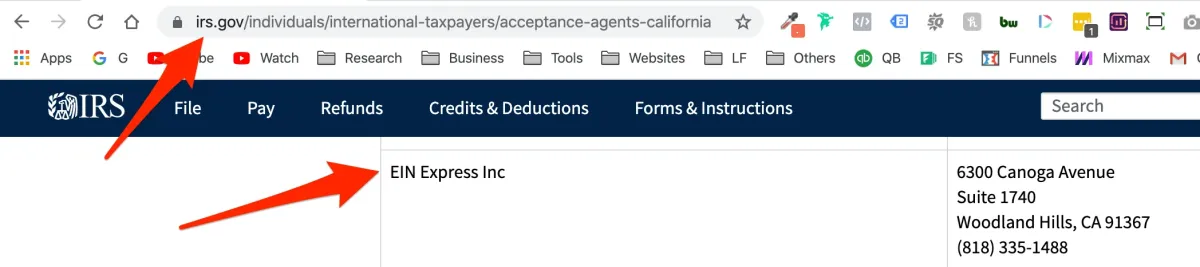

You can find our certification as Certifying Acceptance Agents (CAA) on the IRS website under “Filing Express".

You can find our Certification as IRS Certifying Acceptance Agents on the IRS website under "Filing Express"

EIN Express Inc.

IRS Certifying Acceptance Agents (CAA)

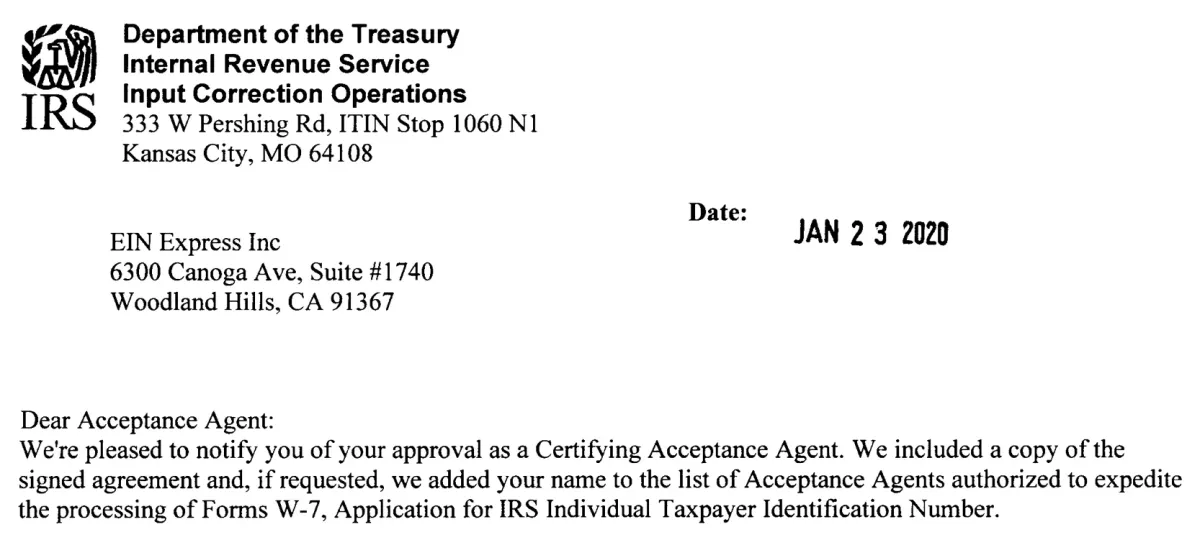

Official Certification From the IRS Certifying Filing Express as

IRS Certifying Acceptance Agents

Top 3 Reasons to Use a

CAA to Get Your ITIN

✅ NO Need to Send Original Documents

Without a CAA, proof of identity and foreign status must be sent to the IRS – this means that you would be mailing your passport to the Texas IRS office.

This will take weeks to process, and it will be risky and dangerous to put important documents like your passport in the mail.

As CAA's, we are certified and trained by the IRS to certify your identification documents ourselves, thus removing the need for you to send to the IRS.

✅ Dedicated Support Line Directly To the IRS

We have a dedicated support line directly to the IRS, as well as a direct email contact with the ITIN office in Texas.

An individual taxpayer does not have this and would have to correspond by mail, which would lengthen the process significantly if any issues arose in the ITIN process.

✅ NOT Waste Time Dealing With Complicated Paperwork

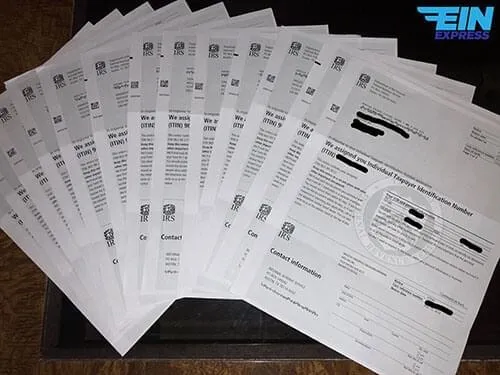

Over 1,000+ successfully assigned ITINs with over 98% success rate, Sina Bonabi, CAA will do ALL the work for you until you successfully get your assigned ITIN.

EIN Express Team (From Top Left to Bottom): Rick Nino, Aman Singh, Mukul Jain, Sam Mollaei, Sina Bonabi, Cristian Duran

Successfully Assigned ITINs For Our Filing Express Clients

ITIN PREMIUM SERVICES

Do More With Your ITIN

Open a U.S. Bank Account

Use your ITIN to open a U.S. bank account and access financial services.

File Tax Return

Submit your U.S. tax returns using your ITIN for compliance and refunds.

Fulfill Tax Withholding

Ensure proper tax withholding on income with your ITIN.

Apply for a Credit Card

Use your ITIN to apply for a U.S. credit card and build credit history.

Open a PayPal Account

Set up a PayPal account with your ITIN for online transactions.

Open a Stripe Account

Use your ITIN to open a Stripe account for business payment processing.

This is All Backed Up By Our

100% Money Back Guarantee!

You're FULLY protected by our 100% Money Back Guarantee!

We take the risk off your shoulders to get your ITIN. No stress or hesitation left.

Our guarantee to you is very simple: Get Your ITIN or 100% Your Money Back.

100% RISK FREE

Frequently Asked Questions

How long does it take to get my ITIN?

ITIN processing times vary based on time of the year. As IRS Certifying Acceptance Agents, once we receive the necessary documentations from you for your, we will immediately file your ITIN application with the IRS.Please keep in mind that due to COVID-19, the IRS is working at limited workforce. As of July 1, 2020 they slowly started bringing back limited number of personnel to work on ITIN applications. The IRS is currently backlogged over 500,000 applications right now and therefore they currently cannot provide any numerical time frame for how long processing will take. Instead they only provide updates on which month’s applications they are currently working on. They are doing everything they can to get through processing ITIN applications as efficiently as they can given the current circumstances.Given the current situation, all we can do is continue to deliver quality ITIN application and tax return preparation service to our clients and file them with the IRS as soon as we can. We will continue to inform our clients about updates in regards to operations and processing times as we get them from the IRS.

What Can You Do With an ITIN?

You can use your ITIN to:

Open U.S. bank account (both personal and business)

File tax return

Open PayPal and Stripe account

Get a credit card

Apply for unemployment

And so much more…

Can I Use an ITIN to Open a Bank Account?

Yes, you will able to open a bank account with your ITIN, and also apply to get a credit card!

Who Need an ITIN?

IRS issues ITINs to foreign nationals and others who have federal tax reporting or filing requirements and do not qualify for SSNs. Examples of individuals who need an ITIN include:

Non-US citizen and do not qualify for Social Security Number (SSN)

Non-US resident alien required to file a US tax return

U.S. resident alien who is filing a U.S. tax return

Dependent or spouse of a U.S. citizen/resident alien

Dependent or spouse of a non-U.S. resident alien visa holder

What Documents Do I Need to Provide to Get an ITIN?

To get your ITIN, you typically need to provide 2 types of documents:

Identification Documentation – Typically a valid passport. If you do not have a valid passport, we will provide you a List of Alternate ID’s you can instead.

Supporting Documentation – Based on the reason why you are applying for an ITIN, we will properly instruct you on how to provide your supporting documents after you fill out the ITIN application and we review your application.

What's a Tax ID?

There’s 2 types of Tax ID's:

ITIN (Individual Tax Identification Number) is a tax ID number for personal use if you don’t have a Social Security Number (SSN).

EIN (Employer Identification Number) is a tax ID number for a BUSINESS. EIN is necessary to lawfully conduct business in the U.S. and EIN is necessary to open a business bank account. We can also help you get your EIN.

You can click here to get your EIN.

How Will I Be Sure I Will Get My ITIN?

Our ITIN service comes with a 100% Money Back Guarantee. Our guarantee is simple: if for any reason, your ITIN application gets rejected, we will immediately issue you a full refund, no questions asked. That way we take on all of the risk for you. 100% Risk Free.

Do I Need to Send My Original Passport?

No, you do NOT have to send us your original passport to get your ITIN.

Since we're IRS Certified Acceptance Agents, we will certify your passport for you so that you don't have to send in your original passport.

Do I Need to Send My Passport Certified?

No, you do NOT have to send us your passport certified to get your ITIN.

Since we're IRS Certified Acceptance Agents, we will certify your passport for you.

Get Your ITIN & Don't Delay Missing Important Deadlines!

Filing Express

IRS Certifying Acceptance Agents

21777 Ventura Blvd Suite 241

Woodland Hills, CA 91316

24/7 Live Support

Phone: 813-591-3168

Email: [email protected]

5.0 out of 5 Based on 3,043 Reviews

Copyright Ⓒ 2024 Filing Express. All Rights Reserved.